Easy Car Finance Calculator

It’s never been easier to get a commercial motor vehicle loan estimate – kickstart your business car leasing journey with a no-obligation quote from our online calculator.

Calculate Repayments for All Types of Commercial Vehicles - Vans, Wagons, SUVs, Utes and More

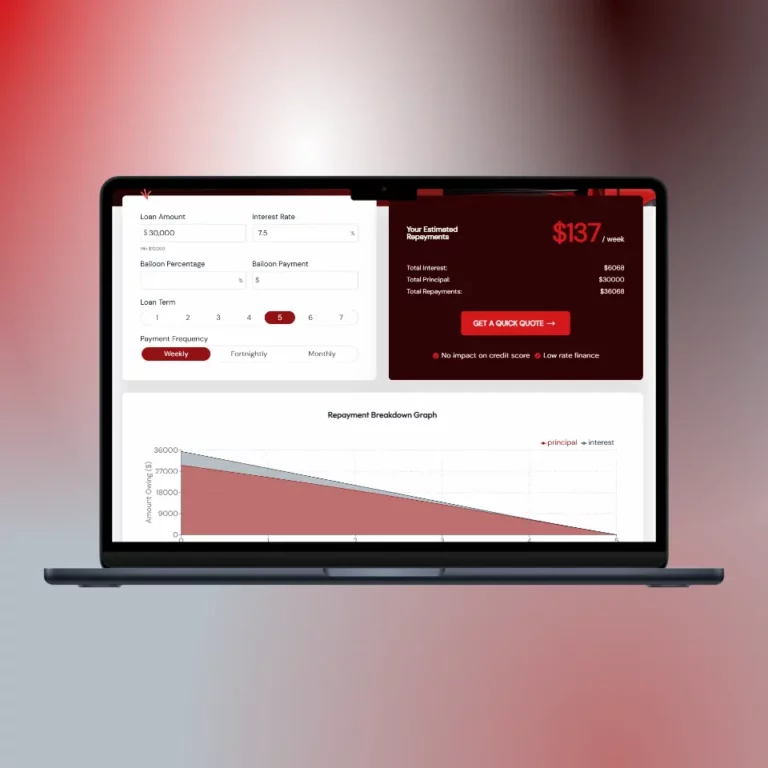

Business operators seeking a car loan for any type of commercial motor vehicle can do so with more certainty thanks to our free online car loan repayment calculator. Whatever commercial credit facility is best suited to your financial requirements – Chattel Mortgage, Leasing, Rent-to-Own, and Commercial Hire Purchase – the device is available 24/7 and can generate estimates based on a weekly, fortnightly, or monthly repayment frequency.

Take the power of car loan repayment estimates into your hands by using the device at a time that suits you, from any location and device with an internet connection. To get started, simply enter the details of your prospective commercial car purchase into the required fields of the device and click ‘calculate’ – it’s never been more simple!

When using the online repayment estimator, our most common query is ‘what interest rate should I enter?’ We recommend referring to our latest ‘best rates’ as a guide when generating repayments. These rates are some of the lowest available on the market thanks to our highly regarded reputation in the lending industry. We are accredited with an extensive panel of 80+ banks and lenders who enable us to offer the full range of commercial credit facilities as well as the most competitive rates in the commercial motor vehicle lending sector.

- Calculate Repayments for Chattel Mortgage, Rent-to-Own, CHP and Leasing.

- Secure Highly Competitive Rates from 80+ Banks and Lenders.

- Use Our Best Rates as a Guide For Generating Repayment Estimates.

Read more...

When using our ‘best rates’ as a guide for generating repayments via the device, it’s important to note that the actual rate you will be offered may differ from the ones advertised. This is because each rate is determined by a business’ individual financial profile and credit history. Interest rates also differ significantly between credit facilities and lenders. To source an accurate quote specific to your commercial profile, request a no-obligation quote from our expert brokers online today!

Prior to committing to the purchase of a new or used commercial car, it’s important to do your research and get answers to the questions you need to know. Our online car loan calculator makes it easy thanks to its ability to provide valuable indications of whether your business can afford loan payments on a specific new or used commercial vehicle.

Don’t waste time viewing and test-driving vehicles that are out of your budget. Calculate monthly repayments for a range of loan amounts and terms to find a purchase that works for you. You won’t need any special mathematical skills to use the device, just type in the relevant values for your lending requirements and get the results seconds later!

Our calculator has the answers you need when preparing for a new or used commercial car purchase. Start estimating now!

Easy’s Commercial Car Finance Calculator - It’s Quick, Simple, and Free!

If you’ve ever researched cars online and tried to figure out the monthly repayments in your head, you know just how tedious it can be. Luckily, our easy-to-use calculator is designed to remove any hard mathematical equations from the purchasing process to give you the information you need. To use the device, all you need to do is plug in the vehicle price, interest rate and loan term and voila! You’ll instantly receive a monthly repayment estimate for the vehicle in question. Use the device anywhere and at any time – it’s perfect for making decisions on the spot!

Figure out the financing that works best for your company by using our super quick and simple repayment calculation tool. To use the device, you’ll need to enter the price of the vehicle (plus any accessories or extras, and minus any deposit or trade-in value) as the loan amount, the interest rate for your chosen commercial credit facility, and your preferred loan term of 1 to 7 years. Hit ‘calculate’ and you’ll instantly get your monthly repayment estimate!

As a business buyer, you will have the option to include a balloon payment or residual. It’s important you don’t subtract this amount from the cost of the vehicle – the calculator will do it for you. It’s easy!

Considering multiple vehicles for your new commercial motor vehicle? You can calculate loan repayment estimates for as many vehicles as you like. It’s an ideal way to analyse Electric Vehicles to see if making the switch makes sense for your budget. Wondering how a fancy version compares to a standard one? No problem – just adjust the loan amount to match the different price and hit ‘calculate’.

Our online calculator does not store results or information. When using the device, be sure to note down your comparisons.

The commercial motor vehicle financing market is widespread. Across this huge market, interest rates vary between lenders and credit products. With so many options available, it can be difficult to locate the best rate for your business profile. Luckily, at Easy Car Finance, we provide each of our borrowers with the most competitive interest rates available on the market. Not only that, but we aim to make the process of acquiring vehicle financing as simple as possible. If you’re interested in seeing how our interest rates stack up against our competitors, you can do so via our online calculation tool!

Buying a commercial motor vehicle with finance is a big decision. Ensure you are well-informed before diving in by utilising all the pre-purchase resources available to you. The more you know, the more confident you will feel moving forward with the car loan application process. To know more about your options, leverage the help of our handy calculator. All you need to do is enter the details for the vehicles you’re considering. Start the process now!

Convert Car Price to Repayment Estimate Instantly

If you’ve ever researched cars online and tried to figure out the monthly repayments in your head, you know just how tedious it can be. Luckily, our easy-to-use calculator is designed to remove any hard mathematical equations from the purchasing process to give you the information you need. To use the device, all you need to do is plug in the vehicle price, interest rate and loan term and voila! You’ll instantly receive a monthly repayment estimate for the vehicle in question. Use the device anywhere and at any time – it’s perfect for making decisions on the spot!

Input Car Purchase Figures into Required Fields

Figure out the financing that works best for your company by using our super quick and simple repayment calculation tool. To use the device, you’ll need to enter the price of the vehicle (plus any accessories or extras, and minus any deposit or trade-in value) as the loan amount, the interest rate for your chosen commercial credit facility, and your preferred loan term of 1 to 7 years. Hit ‘calculate’ and you’ll instantly get your monthly repayment estimate!

As a business buyer, you will have the option to include a balloon payment or residual. It’s important you don’t subtract this amount from the cost of the vehicle – the calculator will do it for you. It’s easy!

Use Device Anywhere, Anytime, As Many Times as You Want

Considering multiple vehicles for your new commercial motor vehicle? You can calculate loan repayment estimates for as many vehicles as you like. It’s an ideal way to analyse Electric Vehicles to see if making the switch makes sense for your budget. Wondering how a fancy version compares to a standard one? No problem – just adjust the loan amount to match the different price and hit ‘calculate’.

Our online calculator does not store results or information. When using the device, be sure to note down your comparisons.

Conduct Simple Interest Rate Comparisons

The commercial motor vehicle financing market is widespread. Across this huge market, interest rates vary between lenders and credit products. With so many options available, it can be difficult to locate the best rate for your business profile. Luckily, at Easy Car Finance, we provide each of our borrowers with the most competitive interest rates available on the market. Not only that, but we aim to make the process of acquiring vehicle financing as simple as possible. If you’re interested in seeing how our interest rates stack up against our competitors, you can do so via our online calculation tool!

Get the Answers You Need Quickly and Easily

Buying a commercial motor vehicle with finance is a big decision. Ensure you are well-informed before diving in by utilising all the pre-purchase resources available to you. The more you know, the more confident you will feel moving forward with the car loan application process. To know more about your options, leverage the help of our handy calculator. All you need to do is enter the details for the vehicles you’re considering. Start the process now!

Plan Before You Apply - Leverage the Benefit of Commercial Loan Repayment Estimates

- Make sure your loan offer is the most competitive.

- Use the repayment calculator for new, used, and luxury commercial vehicles.

- Run repayment calculations for all types of vehicles.

- Plan your loan around the vehicle that fits your business needs.

- Do your research and feel confident throughout the application process.

Stick to Budget by Comparing Your Loan Repayment Options Prior to Applying for Commercial Finance

Borrowers purchasing a car for commercial purposes can have the majority of their questions answered by using our online motor vehicle estimation device. If you want to know if you can afford a specific make and model of car, use our calculator to convert the price of the vehicle to a monthly loan repayment estimate and determine if that amount fits into your budget. If you’re struggling to decide whether to pay a larger deposit on your loan? Vary the total loan amount to allow for different deposits and determine if the repayments are manageable based on your business cash flow.

At Easy Car Finance, we offer loan terms of up to 7 years with approvals subject to lender criteria. Start by entering a small repayment term of 2, 3 or 4 years and increase it until you find a repayment amount you feel confident taking on. The shorter the loan term selected, the larger the monthly commitment will be, but the sooner you will have ownership of the vehicle. The longer the loan term, the smaller your monthly commitment will be but the more interest you will pay over the life of the loan.

As a business operator, you can use the online calculator to work out monthly repayment estimates on any combination of total loan amount, balloon and term to find a loan solution that works with your cash flow. You can also enter as many different rates as you choose and see how they convert to repayment figures.

For an accurate rate and loan term specific to your business’ financial situation, request a quote from our expert brokers online or by phone. We will match you with the right lender and negotiate the best interest rates based on your requirements.

- Plan and set your budget prior to applying.

- Choose a vehicle with repayments suitable to your financial situation.

- Feel more confident in your business car loan commitment.

Turn Estimates into Quotes and Car Loan Offers - Apply for Commercial Motor Vehicle Finance Today!

Once you have received an estimate suitable to your budget, get in touch with one of our expert brokers for an accurate, no-obligation quote. On acceptance of the quote, we will begin the commercial car loan application and approval process to get you on the road as soon as possible. Just upload your details and preferences and we’ll handle the rest!

For streamlined, simple and stress-free commercial car financing with approval in less than 24 hours – apply now at Easy Car Finance.

The Most Frequently Asked Questions

How does the online calculator assist with buying a business motor vehicle?

The online calculator is simple to use. Enter your prospective vehicle’s price, the interest rate and loan term and you’ll instantly receive an estimated monthly repayment for those values. You can adjust the details as many times as you like to include different deposits, balloon payments and loan terms. It’s a very easy way to plan your business vehicle purchase and determine whether the purchase is going to fit into your budget.

Can the calculator estimate loan repayments for any type of commercial car?

Yes. By using our online calculator, you can generate repayments for any type of commercial vehicle. Whether you’re in the market for a van, SUV, ute, wagon or other commercial vehicle – you can instantly receive a repayment estimate based on the vehicle price, loan term and interest rate. Adjust the loan options to match your business’ needs.

What commercial credit facilities can I calculate loan repayments for?

Easy Car Finance offers the full range of commercial credit facilities, and our online car loan calculator can generate repayments for each type – Chattel Mortgage, Leasing, Rent-to-Own, and Commercial Hire Purchase. Enter your loan details and the tool will provide an estimate based on the chosen loan type.

What interest rate do I enter into the calculator for a business loan repayment estimate?

We recommend referring to our ‘best rates’ as a guide when using the online car loan calculator. These rates reflect our highly competitive rates thanks to our accreditation with 80+ banks and lenders. It’s important to note that the actual rate you receive for your car loan may vary based on your business’ financial profile and credit history. By giving our office a call, you can receive an accurate quote to plug into the device.

How do I compare different financing options for multiple vehicles?

You can compare different loan scenarios by simply adjusting the loan amount, interest rate and term to see how each combination affects your monthly repayments. If you are considering different vehicles, just enter the price of the vehicle and observe how the repayments change. Our calculator works for all types of vehicles, from luxury right through to standard.

Can I use the online calculator to compare both new and used commercial vehicles?

Yes, all commercial vehicles can have a repayment estimate generated for them via our online car loan calculator. Whether you’re buying a brand-new van or a pre-owned SUV, start comparing by entering the purchase price, interest rate, and loan term for an instant estimate.

How do I factor in a deposit or trade-in amount when calculating repayments?

When generating a repayment estimate for a new or used commercial vehicle, make sure you subtract any deposit or trade-in value prior to calculating the estimate. By doing this, you will receive a more accurate monthly repayment estimate that reflects your real financial commitment.

What loan terms are available for a commercial motor vehicle loan?

At Easy, we offer loan terms of 1 to 7 years. Our online car loan calculator enables you to adjust the terms of a loan to see how different lengths of time affect your monthly loan repayments. The longer the term, the lower the monthly payments, but you’ll typically have to pay more interest over the life of your loan. The shorter the term, the higher the monthly payments, but you’ll have ownership of the vehicle sooner.

I’m happy with my monthly car loan repayment estimate, what do I do now?

After you have calculated a repayment estimate that works for your business’ financial situation, contact one of our brokers for a personalised, no-obligation quote. We will assist you in finding the best loan option based on your specific business profile. On acceptance of our highly competitive financing quote, we’ll guide you through the application and approval process. We offer approvals in 24 hours or less to ensure you can get on the road as soon as possible.

What is a key benefit of using an online car loan calculator?

By using the online repayment estimator, borrowers are more likely to stick to their budget. The device lets you compare a variety of vehicle prices, terms and interest rates to ensure the repayments match your business’ financial situation. If the repayment estimate you receive isn’t quite right, adjust the details like the deposit amount or loan term to see how they impact your budget.

Let Easy Car Finance simplify the process by taking care of the complicated steps for you, so you can get on with business.